In this case, utilize this calculator observe exactly how much you will need to has actually arranged as a deposit to do the home pick. It calculator commonly imagine their full closing costs plus the needed initial Home loan Premium (MIP). You can use which calculator to select the restrict FHA mortgage limitation to possess a certain buy, however to determine the maximium matter for your condition and you will matter you need to use brand new HUD web site to discover local constraints. Immediately following deciding local constraints you can make use of the fresh new below calculator to contour your instalments.

Newest Local 31-Yr Repaired Home loan Costs

The second table highlights most recent local financial prices. Automatically 30-seasons pick loans was presented. Simply clicking the fresh refinance button switches finance in order to refinance. Other mortgage modifications choice and speed, downpayment, home venue, credit history, title & Arm choices are available for alternatives in the filters town within the top of this new dining table.

A basic Help guide to FHA Loans

Purchasing property is actually a difficult fling, especially if you’re nonetheless strengthening earnings. You are able to struggle with a low credit score and you will decreased funds getting advance payment. Such as is the case that have basic-big date homeowners who possess a difficult time qualifying to own a traditional conventional mortgage.

But never stress. You will find mortgage applications giving low down payment solutions and you can casual credit standards. Even after a reduced credit score, you can however afford a property. One mortgage programs are backed by the fresh new You.S. Federal Homes Government (FHA).

Our very own guide usually discuss the principles from FHA financing and how you can use it on your side. We are going to contrast it that have old-fashioned mortgages and you will explore its pros and cons. By information your loan alternatives, hopefully this article helps you reach finally your homeownership goals.

Preciselywhat are FHA Money?

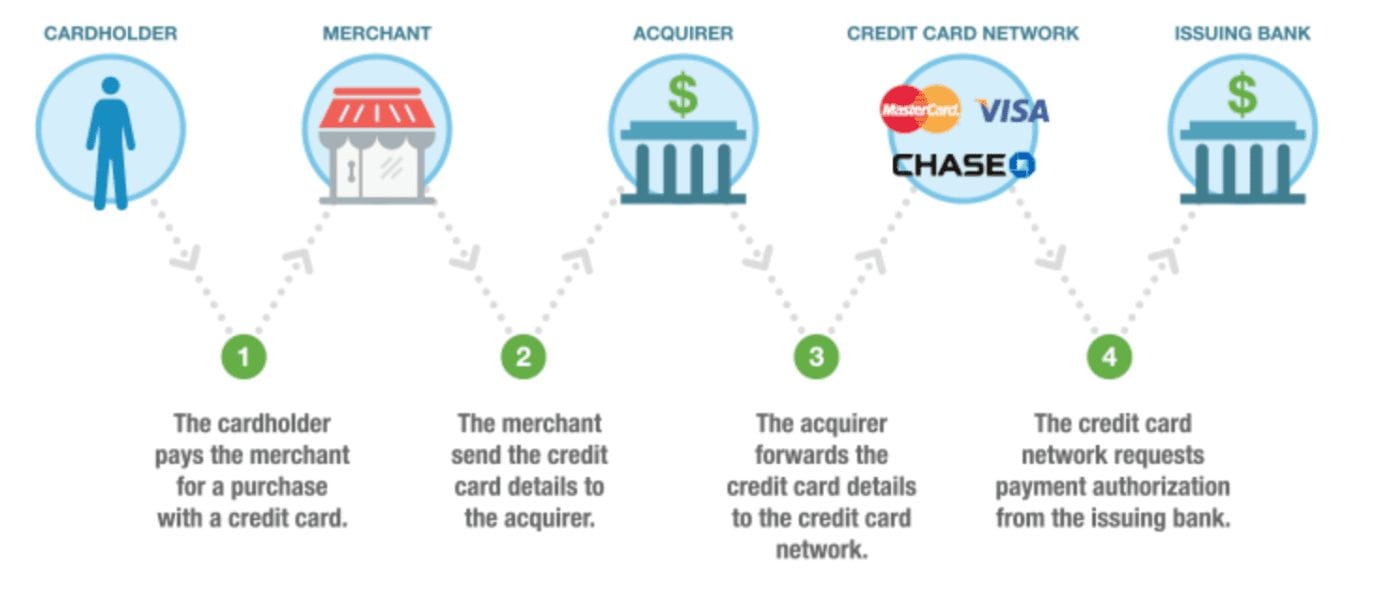

FHA funds is mortgages sponsored because of the Federal Houses Administration (FHA). It ensure mortgages provided by FHA-paid loan providers for example financial institutions, financial businesses, and you can borrowing unions. FHA fund are specially aimed toward http://elitecashadvance.com/personal-loans-tx/early low to average earnings individuals who are in need of direction in getting a property.

FHA finance are a famous capital selection for basic-big date homebuyers and consumers which have rigid finance. They come with lenient borrowing from the bank criteria, low-down costs, and you may reasonable settlement costs compared to antique conventional mortgage loans. FHA financing can be drawn because the 30-year fixed mortgage loans, but they are and in fifteen-year and you can 20-seasons fixed-rates words.

The fresh Federal Housing Administration (FHA) was situated under the National Property Operate regarding 1934. It actually was created in reaction to widespread property foreclosure inside Great Depression. Around 1933, between forty% to help you fifty% from residents defaulted on their mortgage. To alleviate this matter, new FHA was designed to increase funding circulates on construction market.

Ahead of the Great Depression, very home loans came once the changeable-price money having a concluding balloon payment. Borrowers is only able to obtain 50% in order to sixty% to invest in a property. Mortgage loans was basically generally speaking structured with eleven so you can twelve-season amortizing money, that have been way less than the present standard 30-seasons title. In the event your debtor could not pay the higher balloon fee, they remaining refinancing its mortgage to extend the term. This program made it problematic for individuals to pay for houses, and therefore ultimately trigger substantial property foreclosure.

Towards the FHA in place, mortgages had been covered for at least 80% from an excellent house’s worthy of, with a good 20% downpayment. Additionally written lengthened words and you may repaired pricing to give ample going back to consumers to blow its financing. This type of arranged credit strategies at some point enhanced the loan system. From the 1965, the new FHA became part of the U.S. Agencies from Casing and you will Metropolitan Innovation (HUD).