The fresh new and Unanticipated Obligations

Several other preferred reason for loan providers so you can refuse a mortgage after the good pre-acceptance is basically because the fresh borrower has actually acquired a higher level from debt. In the date before you can accomplish your home loan and you will house purchase, you really need to refrain from taking on any further financial obligation than simply you actually have. Actually a small escalation in personal debt or another type of line of credit you will definitely place your financial pre-acceptance at risk. A rise into personal debt, no matter what insignificant, can transform your debt-to-earnings proportion and you may end in the financial becoming refuted.

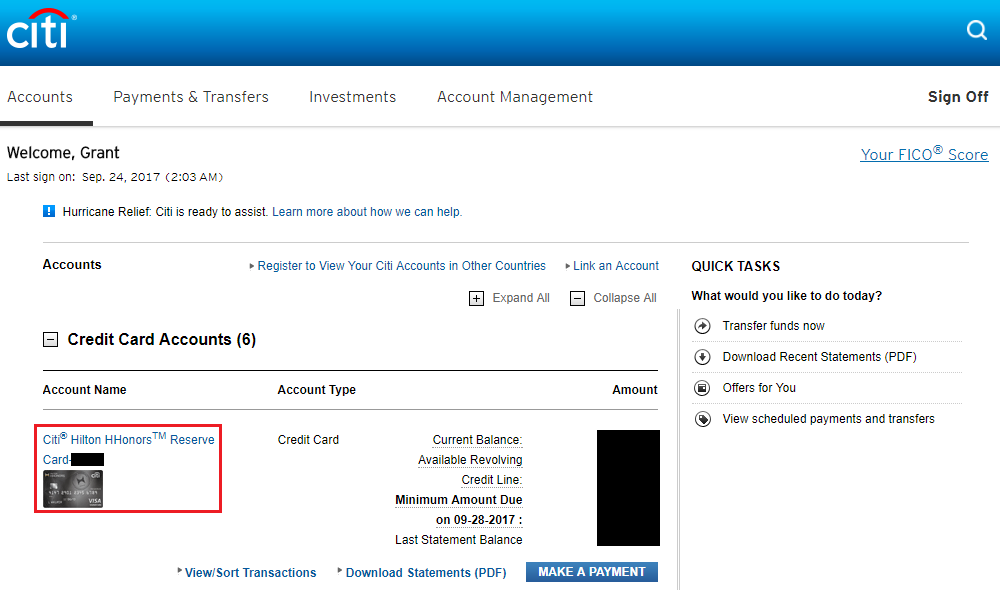

Before you can holder enhance mastercard and take away a good the new mortgage, it is recommended that you check with your mortgage broker about the option. A beneficial large financial company have a tendency to almost always advise you to hold off up until your own papers are closed before making people abrupt financial actions.

Bank Rule Change or This new Standards

It is critical to keep in mind that even though a borrower possess come pre-passed by their bank, they may not be excused from people the new guidance otherwise conditions you to the us government otherwise personal lenders use. If the a https://www.elitecashadvance.com/personal-loans-ne/blue-springs lender changes their lowest borrowing from the bank demands out-of 600 in order to 620, individuals which have a lowered credit history will lose the mortgage pre-acceptance. Even though this may sound hard, good mortgage broker is able to get you acknowledged which have another bank whose limits is actually somewhat more.

Most other alter in order to lender conditions otherwise certification guidelines that may trigger your own mortgage to get denied immediately following pre-acceptance are debt so you can money tip transform and you will variations into the amount of offers questioned out-of a purchaser.

The Assessment Is available in Too Lowest

If you find yourself to shop for property straight from the fresh creator, compared to most cases it’s not necessary to have the house appraised, in addition to banking institutions provides you with a mortgage situated into purchase price your spending money on they. Whenever you are to buy a good pre-current or pre-stayed in household, after that more often than not the borrowed funds financial requires an assessment you to definitely is carried out of the an accredited appraiser of your own lender’s choice.

Unexpected outside issues in this way have demostrated as to why borrowers must always works with a mortgage broker and you may community specialist who can assist them to navigate such as for example unexpected things.

A common concern that is requested because of the individuals is where they normally make sure the home loan does not get denied after the its pre-recognition. You may be thinking dumb, however the best solution is to keep performing exactly what your have been creating one which just pre-approval. Since you already got approved for a home loan, all you need to create is actually stay-in a similar financial status since you performed ahead of your pre-acceptance. Home financing pre-recognition generally can last for 120 months which means your occupations while the good borrower is to maintain your funds regular if you don’t purchase your family. Lenders and you may home loans perform all things in its power to see as much of its pre-approvals get to closure, so you don’t have to performs too much.

Here are a few more approaches for borrowers that need while making sure the financial will not get rejected last second:

- Never generate high places in the bank account over the past 90 to 120 days just before their home loan is due to personal and finance with out facts concerning where the currency came of

- Usually do not withdraw large amounts of cash out of your bank account in this you to same time frame

- Never take on almost every other personal lines of credit, this new playing cards, this new auto loans, or other kinds of fund

- Don’t accrue a lot more debts by carrying increased balance on your existing credit cards