Buying your earliest home is a massive milestone-one that comes with enough important decision-and also make and you can a giant monetary responsibility. Thanks to this it is vital to prepare yourself before you can even start to look during the domiciles. Among the many things that you need to do when buying a home is always to be sure that you get cash manageable. Real estate loan characteristics are plentiful and you will usually consult which have a mortgage administrator within the Georgia to browse the method.

Have no idea the direction to go? I have wishing an easy number that you could consider while preparing to own a home purchase:

1. Look at your offers

How much you want have a tendency to mostly count on the value of the house you should get. Off money usually rates anywhere between 10 and you will 20% of your own home’s well worth.

It is important getting substantial savings and you can a spending plan from inside the spot for property get. If not, it is high time to manufacture a real plan which means you can generate dollars and discounts with the purchase. The earlier you begin controlling your money in preparation to possess a home pick, the earlier you could start your travel towards the getting the first house.

step 3. Look at the borrowing state

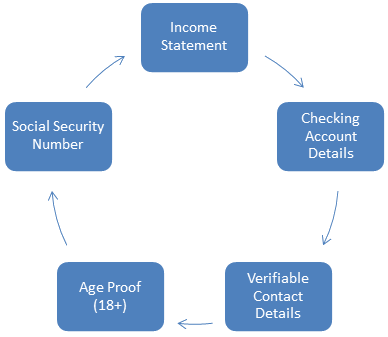

A mortgage officer into the Georgia can look within different activities so you can influence the ideal mortgage rates to you personally. This type of activities usually range from the level of offers you have and you may helps make designed for a first percentage towards a property, possible dangers toward income otherwise income source, and also have importantly, your credit score. Most of the point that the credit rating https://elitecashadvance.com/loans/no-teletrack-payday-loans/ try timid out-of 800, could pay significantly more when you look at the interest. So the borrowing is prepared for property home loan, its smart to check and you may keeping track of your credit history, paying down the money you owe (if any), and you can reading away financial factors, that all help you care for a good credit score.

Of the examining your bank account, possible dictate just how much you really can afford to pay towards a mortgage loan. Mortgage loan characteristics can be extremely helpful in determining the way you is also control your cash because you pursue a house pick. Other than your credit rating, loan providers generally speaking account for additional factors to decide your capability to settle their financial, such as your earnings, the monthly costs, your own financial comments, an such like.

5. Have you got an area at heart?

Now you recognize how far domestic you really can afford, it is time to think about your choices with respect to area additionally the brand of assets we want to inhabit.

Build a listing of the items you want to features into the a new domestic such as the quantity of bedrooms, baths, garage area, outdoor features, as well as enhancement prospective such as a basement that can easily be converted towards a house gym or perhaps a facility. This info can be well make it easier to restrict the options.

In terms of venue, consider communities that will be near to everything you may need availability so you can inside a residential district. Research the cover additionally the standard character of close city, such its offense statistics, new amenities available inside society, while the transportation links for sale in and you may out of the area.

6pare prices

When shopping for a home, we would like to have the best deal from your own get. Thanks to this its smart to apply for several finance so you won’t have to be pinning your own dreams on a single home loan resource. This may plus give you the opportunities to compare cost and get the very best offer from your chose bank.

When considering taking right out home financing on your earliest household, it is crucial are open to a demanding loans. Queensborough National Bank normally show you to help you a talented and experienced mortgage loan administrator inside Georgia who’ll direct you thanks to all of the the loan loan qualities that the bank and you will faith providers offers. The firm considers it a good right being assist you with your property purchase courtesy different varieties of financing and you can mortgage functions he has got to be had.